Square, Inc. stock is now up over 200% year-to-date as the company has increasingly gained traction with small to medium businesses. How do analysts view the revenue drivers and the concerns going forward?

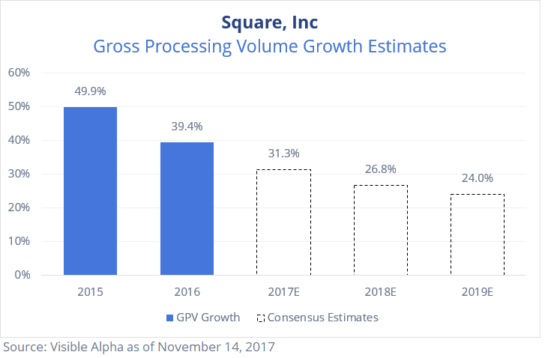

Square’s business starts first and foremost with its payment processing. The company charges a fee to sellers to process their payments, and these fees now make up 70% of total adjusted revenue. Square processes payments primarily for small businesses, where its ease of onboarding and point-of-sale tools have been its primary drivers of growth. However, the company is also increasingly signing on larger merchants that drive higher transaction volumes. Going forward, analysts are expecting roughly 25-30% annual growth in gross payment volume (GPV) over the next three years, driven mostly by larger merchants. Analysts have also revised this number upward since Square’s IPO at the beginning of this year by about $25 million.

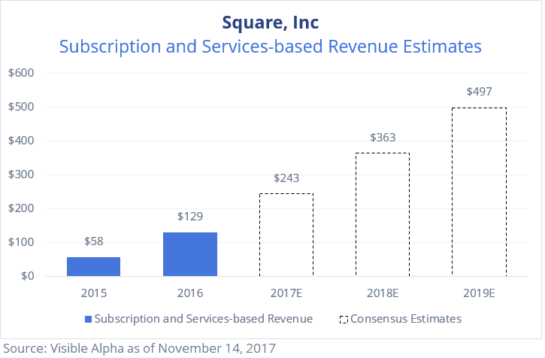

Square has also used the data from payments to augment other recently launched products and services. The company now offers capital, delivery services, payroll, and analytics, among other services. This group of products has grown significantly over the last several years, and analysts are forecasting them to continue to drive growth. Estimates have also been revised upwards by about $40 million since the beginning of the year.

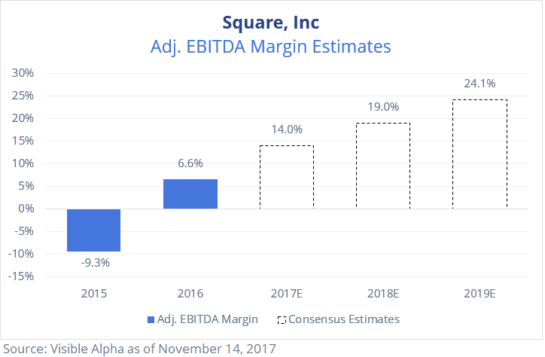

One concern is that margins may become pressured as larger merchants sign on and seek volume discounts. However, the shift towards Subscription and Services should help offset some of this margin pressure as they carry higher adjusted EBITDA margins. Note that the company has targeted 700 bps of adjusted EBITDA margin improvement year-over-year and a longer-term adjusted EBITDA margin of 35-40%. Analysts appear to agree with this view, as they project over 700 basis points of adjusted EBITDA margin growth in 2017 and about 500 basis points annually thereafter, reaching 24% by 2019.