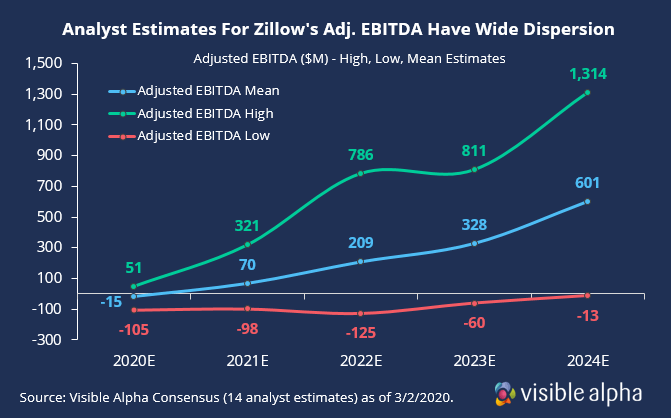

Questionable Profits

Zillow analysts have widely different views on the company’s future profitability as they transform into a real estate iBuyer. The company is in the midst of an ambitious multi-year transition to “Zillow 2.0” that began in 2018 with Zillow Offers, a program allowing homeowners to sell directly to Zillow to be remodeled and resold. Many analysts are skeptical if the iBuyer model can achieve long-term profitability, and Zillow’s core business – Internet, Media & Technology (IMT) – is expected to offset on-going losses from the Home segment in the near-term. The company guided for breakeven consolidated adjusted EBITDA in 2020, but consensus estimates are projecting a small loss.

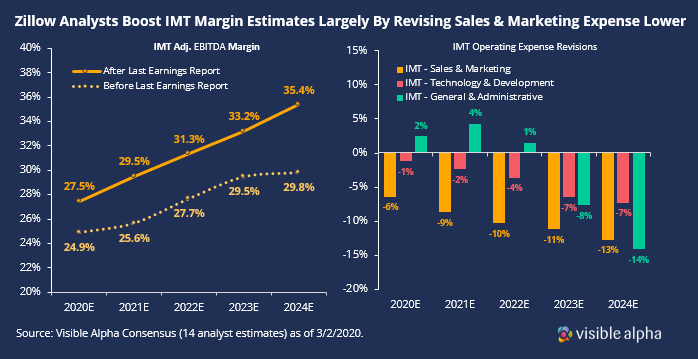

Operating Leverage Improves IMT Profits

Zillow’s core business, Internet, Media & Technology (IMT) is performing well in part due to accelerating subscriptions and near-record high retention rates for Premier Agent, a service that sells leads to realtors. IMT’s adj. EBITDA margin is also expanding through cost discipline and more prudent resource allocations. Analysts believe operating leverage can continue improving IMT margins and raised estimates largely by cutting future projections for marketing expenses. Following Zillow’s latest earnings report, IMT’s 2020 adj. EBITDA margin estimates increased to 27.5% from 24.9%.

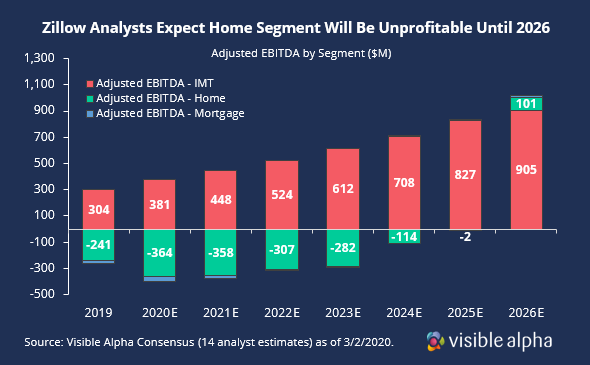

Home Segment Losses Expected Through 2026

Zillow’s Home segment reported worsening unit economics in the company’s latest earnings report despite better pricing and an overall favorable housing market, largely due to higher variable costs like remodeling. Zillow Offers is now available in 23 markets, and the company is on track to add three more markets by mid-2020. Zillow believes 2-3% long term EBITDA margin is possible, but that is before interest expenses. Analysts are currently projecting losses from Zillow’s Home segment will continue until 2026.

This content was created using Visible Alpha Insights.

Visible Alpha Insights is an investment research technology platform that provides instant access to deep forecast data and unique analytics on thousands of companies across the globe. This granular consensus data is easily incorporated into the workflows of investment professionals, investor relations teams and the media to quickly understand the sell-side view on a company at a level of granularity, timeliness and interactivity that has never before been possible.